Click here to get a history report for your choice of fund(s).

| Target Fund | Comparison Fund | |

|---|---|---|

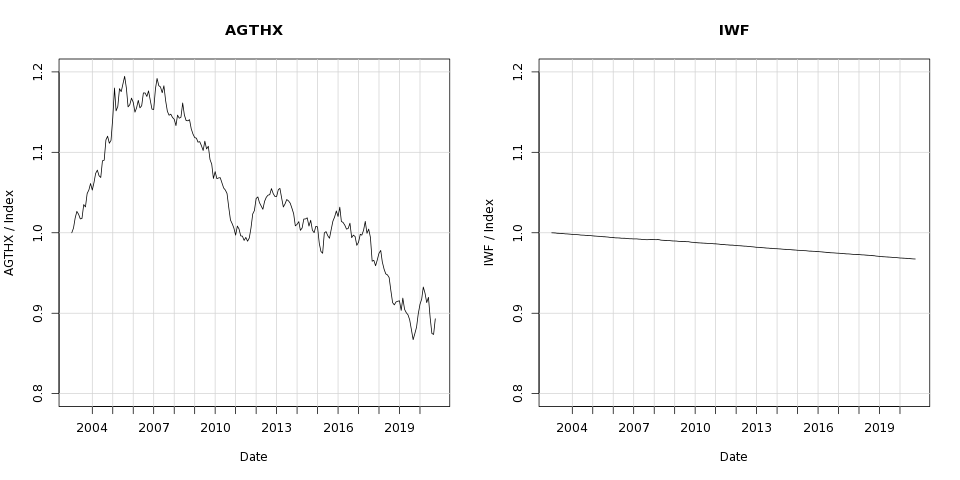

| Ticker / Name | AGTHX / Growth Fund of America; Class A Shares | IWF / iShares Trust: iShares Russell 1000 Growth ETF |

| Fund Class | Large-Cap Growth | Large-Cap Growth |

| History Dates Back To | Jan 1, 2004 | Jan 1, 2004 |

| Benchmark Index | Russell 1000 Growth Total Return Index | Russell 1000 Growth Total Return Index |

| Loads* | Front end load of up to 5.75% | No load |

| Tax Treatment |

Ordinary Income, Short-Term Capital Gain Rate: 35.8% Long-Term Capital Gain, Qualified Dividend Rate: 18.8% |

|

*Note: Since the actual amount paid by the investor in the form of a load depends on numerous factors, the calculations on this page do not take loads into account. An investor in this fund should be aware that the "Final Value"s and returns shown below for hypothetical investments in the fund should be correspondingly reduced by the load that the investor is subject to.

For a hypothetical investment of $10,000 made on Jan 1, 2004 and liquidated on Sep 30, 2021.

| Average Annual Return | Correlation | Final Value of Matching Index | Final Fund Value (untaxed) |

Final Fund Value (net of all taxes) |

Total Lifetime Fund Costs* (current dollars, adjusted for inflation) |

|

|---|---|---|---|---|---|---|

| AGTHX | 11.34% | 97.2% | $75,306 | $67,258 | $55,970 | $8,145 |

| IWF | 11.84% | $75,306 | $72,851 | $60,902 | $2,206 |

| Expense Ratio | Turnover | |||||

|---|---|---|---|---|---|---|

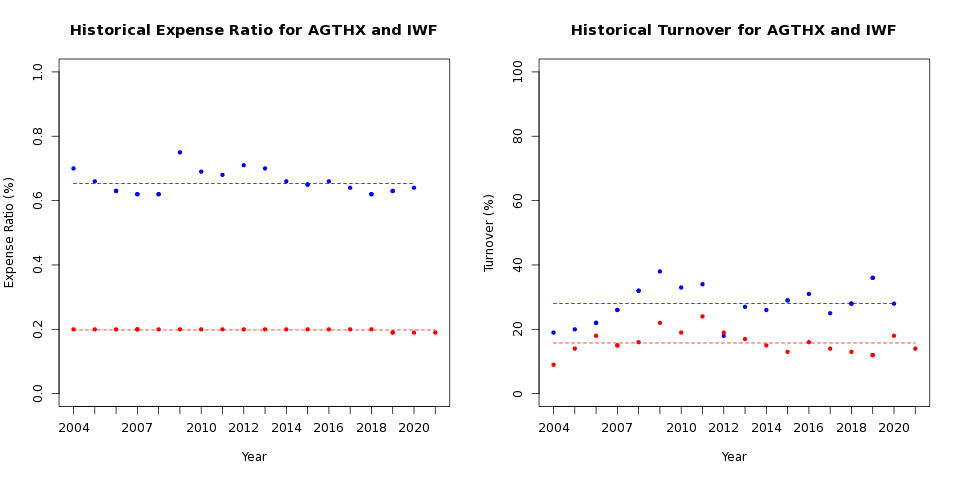

| Lowest Year | Average | Highest Year | Lowest Year | Average | Highest Year | |

| AGTHX | 0.62% | 0.65% | 0.75% | 18% | 28% | 38% |

| IWF | 0.19% | 0.20% | 0.20% | 9% | 16% | 24% |

|

|

|---|

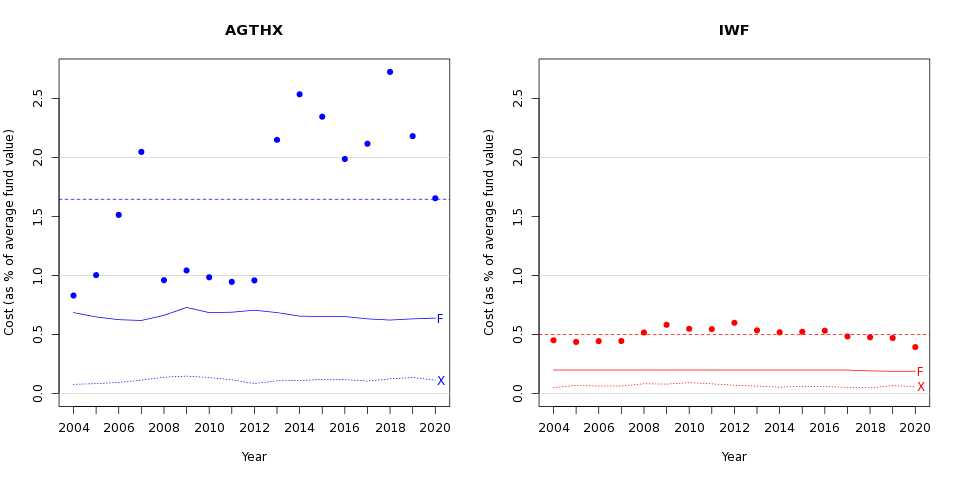

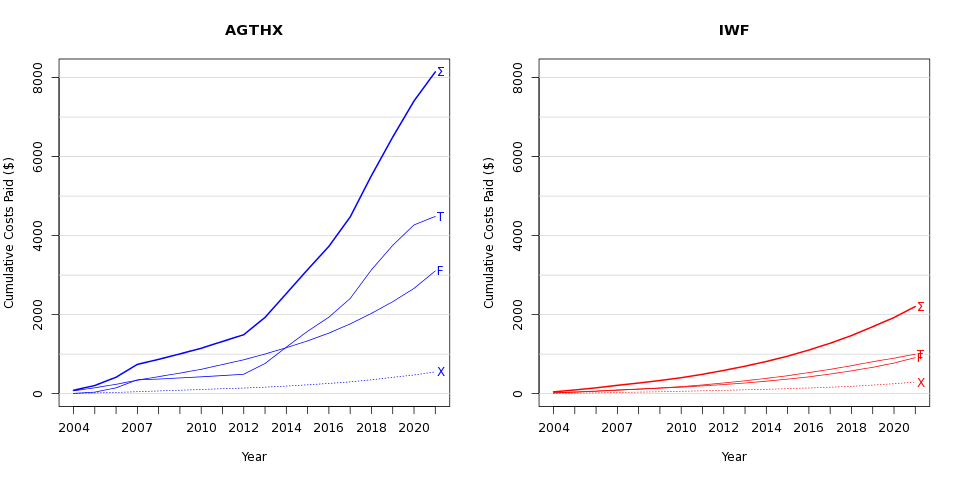

| Total | Fees | Transaction Costs | Taxes | |||||

|---|---|---|---|---|---|---|---|---|

| Lowest Year | Average | Highest Year | Average | Average | Lowest Year | Average | Highest Year | |

| AGTHX | 0.83% | 1.65% | 2.72% | 0.66% | 0.11% | 0.07% | 0.87% | 1.98% |

| IWF | 0.39% | 0.50% | 0.60% | 0.20% | 0.07% | 0.14% | 0.24% | 0.33% |

|

|---|

| Total | Fees | Transaction Costs | Taxes* | |

|---|---|---|---|---|

| AGTHX | $8,145 | $3,106 | $553 | $4,486 |

| IWF | $2,206 | $912 | $294 | $999 |

|

|---|

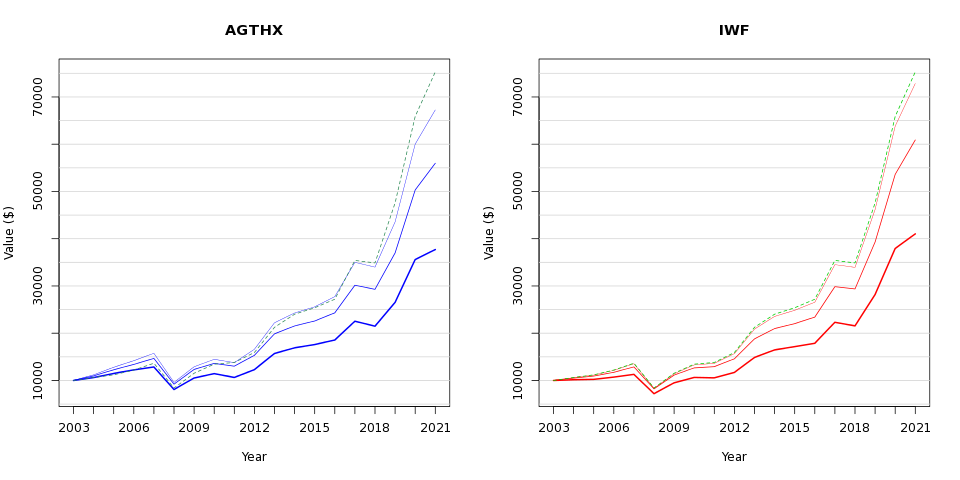

For a hypothetical investment of $10,000 made on Jan 1, 2004 and liquidated on Sep 30, 2021.

| Matching Index | Tax-Exempt Fund, Current Dollars |

Net of Taxes, Adjusted for Inflation (Current Dollars) |

Net of Taxes, Adjusted for Inflation (2004 Dollars) |

|||||

|---|---|---|---|---|---|---|---|---|

| Value | Avg. Ann. Return | Value | Avg. Ann. Return | Value | Avg. Ann. Return | Value | Avg. Ann. Return | |

| AGTHX | $75,306 | 12.05% | $67,258 | 11.34% | $55,970 | 10.19% | $37,707 | 7.76% |

| IWF | $75,306 | 12.05% | $72,851 | 11.84% | $60,902 | 10.71% | $41,029 | 8.28% |

|

|

|---|

For a hypothetical investment of $10,000 made on Jan 1, 2004 and liquidated on Sep 30, 2021.

| Tax-Exempt Final Value of $10,000 Initial Investment |

Annualized Average Return |

Monthly Std. Dev. |

Correlation With Index |

Tracking Error Against Index |

Sharpe Ratio | Risk Adjusted Return Relative to Index |

|

|---|---|---|---|---|---|---|---|

| AGTHX | $67,258 | 11.34% | 4.25% | 97.2% | 1.02% | 0.209 | 1.00% |

| IWF | $72,851 | 11.84% | 4.32% | 100.0% | 0.01% | 0.215 | 1.03% |

| Russell 1000 Growth Total Return Index | $75,306 | 12.05% | 4.32% | - | - | 0.219 | 1.05% |

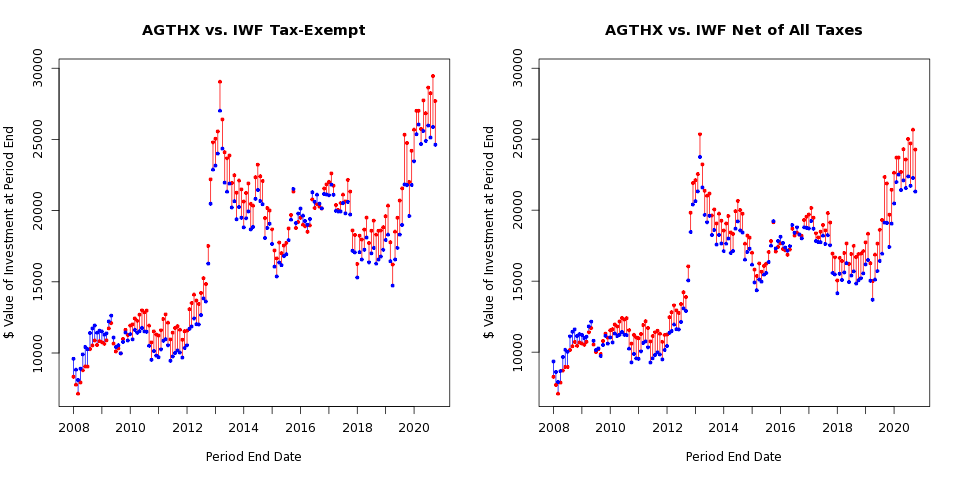

For $10,000 investments made at the beginning of respective periods and liquidated five years thereafter.

Periods are formed monthly with the first period starting Jan 1, 2004 and ending Dec 31, 2008,

and the latest period starting Oct 1, 2016 and ending Sep 30, 2021.

|

|---|

| How often did AGTHX outperform IWF ? | What was AGTHX 's median outperformance over IWF (negative value represents underperformance) |

|

|---|---|---|

| Tax-Exempt | 34 out of 154 5-year periods (22%) | ($1,375) or -7.5% |

| After-Tax | 32 out of 154 5-year periods (21%) | ($1,203) or -7.0% |

For help interpreting the History Report, click here.

To look up the history of another fund, go back to the previous page or click here

© 2021 Useful Work, Inc. d/b/a Personalfund.com

This is a BETA version. We invite your questions, comments, suggestions, and error reports. Email: support@personalfund.com.