My article with that headline is now published on Advisor Perspectives.

“Readers of this publication know the costs of an investment product reduce the net return and consider cost as an important criterion for selecting investments to make up client portfolios. But how do advisors define costs, and how important is cost reduction compared to other portfolio objectives?”

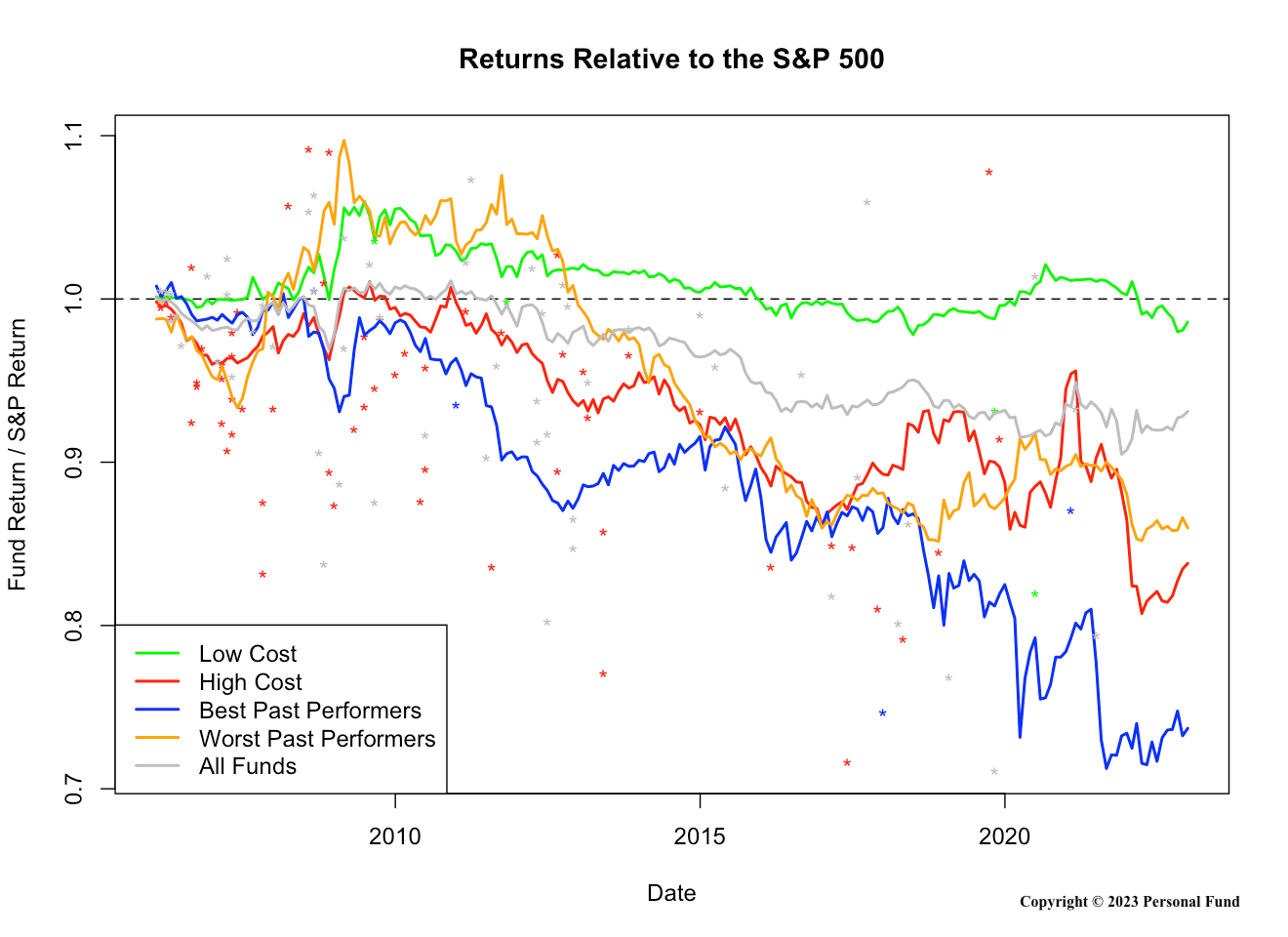

And take note of this graphic included in the article. It shows the median cumulative returns relative to the S&P 500 for different sets of Large-Cap Core funds bought in 2006 and held through 2022. The group with the lowest expense ratios had the highest returns. The funds with the highest returns before 2006 had the lowest returns in the subsequent period.