Show Investors the True Cost of Their Portfolios

The Best Fund Cost Analysis

For the Best Chance of Achieving Financial Goals

Because controlling costs works better than predicting performance

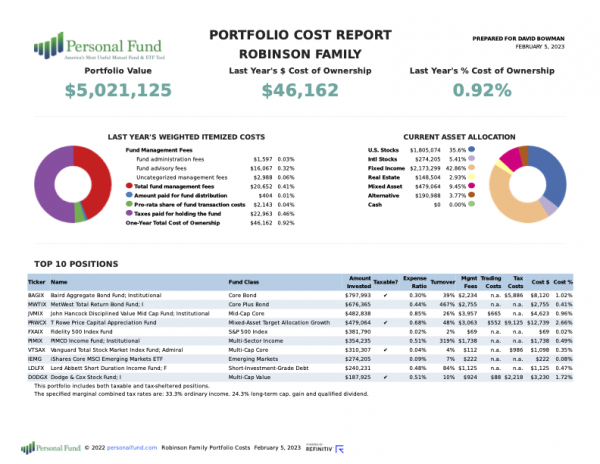

Show investors what they are really paying

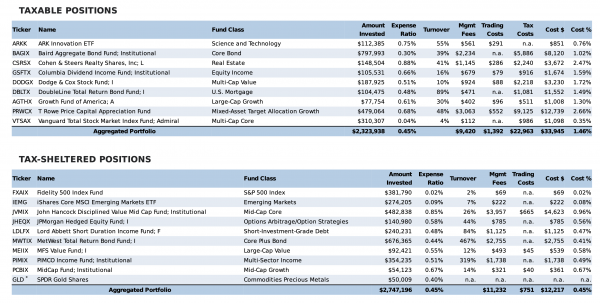

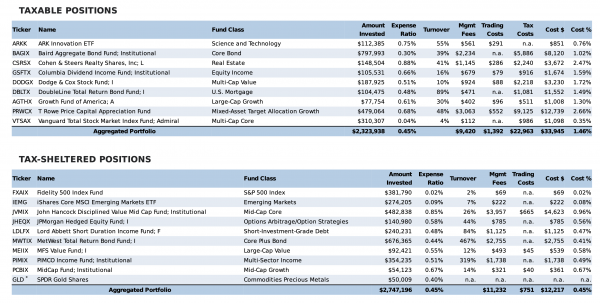

An investor’s real performance depends on how much they keep of what they earn. Expense ratios are often less than half of their total costs and aren’t a great measure of what they’re losing to those costs. Help investors see their actual investment costs today, so you can help them keep more of what they have tomorrow.

Build less-expensive portfolios and models, in minutes.

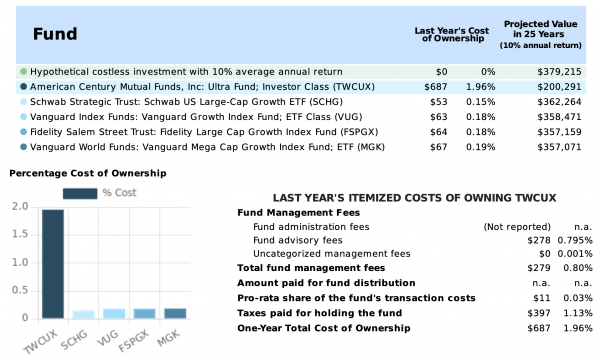

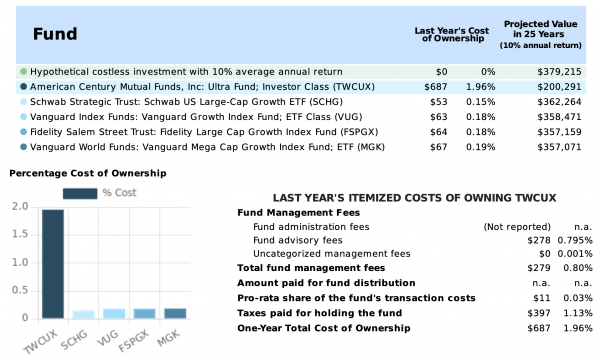

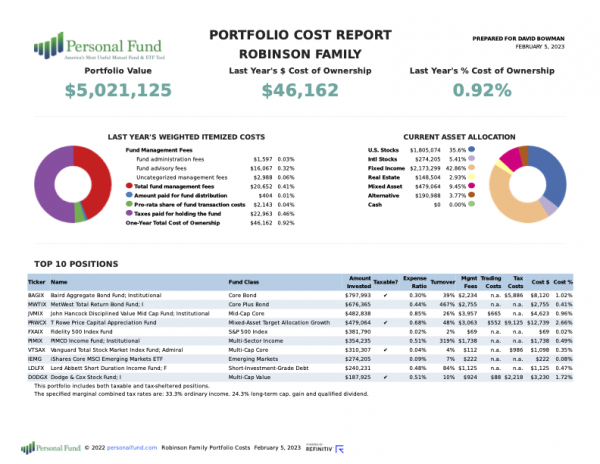

The Personal Fund Portfolio Analyzer shows you exactly what a portfolio or model really costs, including important expenses you won’t see anywhere else. Identify expensive holdings and find low-cost alternatives in minutes with the Fund Screener. A savings of just 75 bps annually compounds to over 20% more wealth after 25 years.

Tell a clear story and build trust with a professional presentation.

People want to work with a professional they can trust. In fact, 73% of investors say transparency is their #1 factor in choosing an investment advisor, but 38% don’t think they pay any investment fees, or don’t know what they pay. With clear and professional one- click reports, help investors demystify their costs, and stand apart as an advisor they can trust.

Changing the Game with More Reliable Alpha

Like returns, the costs you pay to hold an investment compound over time. Most investors, even sophisticated wealth managers, measure an investment’s cost by its visible fund fees or expense ratio. These fees make up only a portion of what you pay. Other hidden fees and taxes can play a much larger role in an investment’s overall cost and your resulting return.

Our research and analysis of these fees bring them into the light of day.

We’re reading the data, not the tea leaves. If you want a reliable way to improve the likelihood of better investment performance, cutting costs should be a critical part of your strategy. Personal Fund is the only place to measure total cost and to help investors predictably keep more of what they earn.