Welcome to Personal Fund. We make it easy for an investor to see, and for you to show prospects and clients what they are really paying for investments, why it matters, and how to keep more of what they earn.

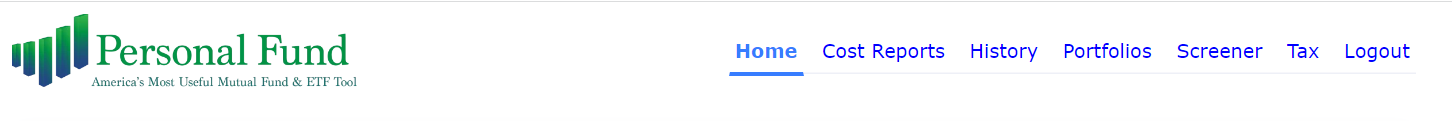

If you haven’t done so already, sign-up to use the tools. Once you’ve signed-up and logged in, you will see the Application Menu at the top of the screen:

Every page on Personal Fund tells you exactly what to do next to get the information you’re looking for. Let’s look at the 5 general questions we can answer. These correspond to the 5 main navigation buttons at the top of the screen between Home and Logout.

- Cost Reports – What are the costs for a certain fund or ETF?

- History – What did a fund or ETF cost over some past period of time?

- Portfolios – What are the aggregated costs for a given portfolio or account?

- Screener – What are the lowest-cost funds or ETFs for me in a given category?

- Tax – What is my investment tax rate?

Let’s run a test case:

- Pick an investment account. For this test run, choose a real account of a client or prospect, preferably with around 10 or fewer holdings, and pull up a recent account statement.

- Log in to personalfund here, and you will reach the Welcome Page. Now let’s answer those questions from above for this client.

- Cost Report – What are the costs for a certain fund?

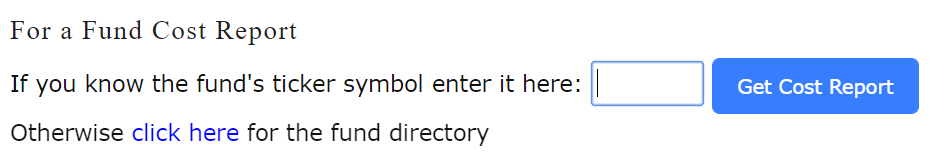

- At this spot on the Welcome Page:

Enter the ticker for the first fund on the statement and click the Get Cost Report button. - Follow the prompts on the Cost Query Page, then click the Get Cost Report button.

- Download the Printable PDF in the top right corner. On this report, you can quickly see:

- The cost of ownership in dollars and percentage compared to alternatives

- The projected value compared to alternatives

- A detailed breakdown of the funds salient and hidden costs

- Complete fund detail

- At this spot on the Welcome Page:

- History – What did a fund cost over some past period of time?

- Click on the History link in the Application Menu at the top of the screen.

- Enter the ticker for the first fund on the statement, follow the remaining prompts and click the Get History button.

- Scroll to the Summary results to see:

- Average annual return

- Value: Benchmark vs. pre-tax value vs. post-tax value

- Total cost in dollars

- Keep scrolling for more detail.

- Portfolios – What are the aggregated costs for a given portfolio or account?

- Click on the Portfolios link in the Application Menu at the top of the page.

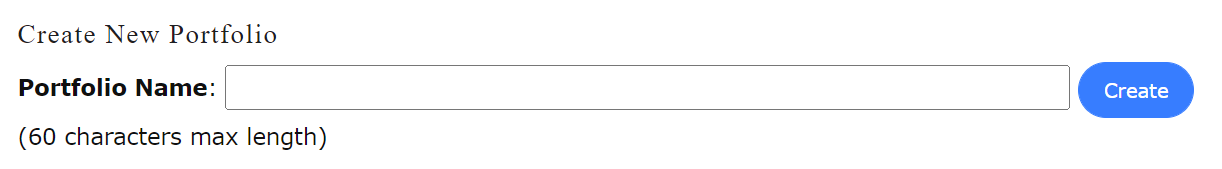

- Create a test portfolio at this spot on the Portfolio Analyzer page:

- On the resulting page (“Portfolio Detail”), set the tax rates. Then using the account statement, add the positions to the test portfolio either manually or by uploading a csv file. When you’ve finished entering the positions, click the Return to portfolio list button at the bottom of the page.

- Click the Review button, then click on the Download PDF link in the top right corner to obtain a printable report. On this report, you can quickly see:

- The cost of ownership in dollars and percentage

- A summary breakdown of the portfolios salient and hidden costs

- A detailed holdings breakdown

- Click here for a full sample portfolio report.

- Screener – What are the lowest-cost funds for me in a given category?

- Click on the Screener link in the Application Menu.

- You can search for funds by asset type, or for funds whose names match a particular search term.

- Follow the prompts to choose what kind of investment option you’re looking for and click the Screen for Funds button.

- Personal Fund shows you a list of 10 lowest-cost funds matching your criteria.

- Tax – What is my investment tax rate?

- Click on the Tax link in the Application Menu.

- Follow the prompts and click the Estimate Tax Rates button.

- Personal Fund shows you the combined marginal tax rates that apply to your investment income at different income bands

- Cost Report – What are the costs for a certain fund?

Review the results with your client or prospect:

- Using the two downloaded reports, help them uncover:

- What costs they are really paying

- How much these costs impact their returns in real dollars

- Why managing cost is more effective than predicting returns

- How to stop overpaying

Still have questions or need help?

- See the detailed Help Guides for each feature by clicking on the embedded links in the respective pages.

- Read the research that makes Personal Fund unique.

- Email us with your questions: support@personalfund.com